Shahab Waheed is a seasoned professional with broad experience in various aspects of investment, accounting and financial management.

Manager | Financial Planning & Investments Analysis

Property Acquisition Specialist | Masters in Management, Imperial College London

Taxation and Corporate Advisory Expertise

A Global Leader in Advisory, Strategy, and Value Creation

A Global Leader in Advisory, Strategy, and Value Creation

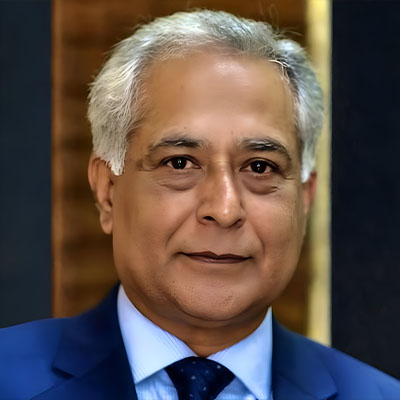

With over five decades of international professional, advisory, and entrepreneurial experience, Mr. Chaudhry brings exceptional leadership and strategic insight to his role as Chairman. His distinguished career spans senior positions with leading global firms including KPMG (London and Barcelona), A.F. Ferguson (now PwC Pakistan), and Ernst & Young (EY) Middle East, where he served as a Partner for more than 22 years. At EY, he established and led the Corporate Finance Lead Advisory Practice across the Middle East, guiding transformative engagements and driving sustained client growth across diverse industries.

Global Expertise, Deep Regional Relationships

Over 33 years in the Middle East, Mr. Chaudhry developed trusted relationships with many of the region’s leading family business groups and institutions across Saudi Arabia, the UAE, Bahrain, Kuwait and Qatar. His expertise covers corporate finance, M&A, valuations, debt restructuring, and performance improvement, serving sectors including banking, oil & gas, construction, hospitality, and manufacturing. His leadership on complex equity placements, infrastructure financings, and cross-border transactions has earned him a reputation for strategic clarity, financial rigour, and integrity.

Entrepreneurship and Strategic Vision

Beyond advisory, Mr. Chaudhry has successfully led a portfolio of entrepreneurial ventures in Bahrain, Canada, UAE and the United Kingdom. He installed a Ferro Alloy plant with a captive power unit and a Steel Rolling Mill in Bahrain established three childcare centers in Ontario serving more than 300 children and manages a network of fuel stations in the UK. These ventures reflect his hands-on business acumen and commitment to operational excellence. Mr. Chaudhry has also contributed to landmark real-estate initiatives, including Dubai’s Island of Italy within The World development, and continues to advise family-owned enterprises on strategic, financial, and growth matters.

A Legacy of Integrity and Excellence

A Fellow of the Institute of Chartered Accountants in England and Wales, Mr. Chaudhry’s career exemplifies trust, professionalism, and tangible impact. As Chairman, he brings a measured global perspective, unwavering commitment to ethical leadership, and a proven record of value creation. His vision is to guide the firm towards sustainable growth anchored in insight, innovation, and enduring client relationships.

Experienced Professional in Business Development and New Markets

Experienced Professional in Business Development and New Markets

With over four decades of hands-on experience in business advisory and entrepreneurship, Mr. Razi Khan has successfully introduced renowned international brands such as Mothercare, LEGO, and Avent into new markets. He has also played a key role in building and expanding brands like Thirsty, Le Shark, Tommee Tippee, and Tropicare across the UK and European markets.

Mr. Khan specializes in business restructuring, rejuvenation, and market expansion, with a proven track record of identifying and developing untapped opportunities.

A Chartered Accountant by qualification, Mr. Khan holds a Master’s degree in Management (specializing in New Ventures) from Imperial College London, where he also lectured in New Venture Creation and Accounting for several years.

As the President of the UK Pakistan Chamber of Commerce & Industry (UKPCCI), Mr. Khan played a pivotal role in organizing an Investment Conference in London in collaboration with the Punjab Board of Investment, attended by the Chief Minister of Punjab. The initiative yielded measurable investment outcomes. During his tenure, UK imports from Pakistan grew by 32%, driven by his extensive marketing and promotional efforts.

Mr. Khan was also instrumental in the formation of the Pakistan Britain Trade and Investment Forum (PBTIF), a bilateral initiative conceived by the heads of state of the UK and Pakistan to strengthen trade relations. He authored the forum’s concept paper and implementation plan, and was later appointed as its first Secretary General, tasked with establishing and managing the organization.

Previously, Mr. Khan served as an Executive Director at the Institute of Chartered Accountants of Pakistan (ICAP), where he significantly enhanced the visibility and growth of the profession. Under his leadership, student enrollment increased by 24%, far exceeding the usual annual growth of 5–6%. To meet this demand, he successfully arranged the acquisition of 11 kanals of land for ICAP’s expansion.

Additionally, he broadened the Institute’s outreach by introducing the Directors’ Training Program to the Government of Punjab with a focus on improving governance in the public sector.

Syed Mohammad Shabbar Zaidi is one of Pakistan’s most distinguished chartered accountants and taxation experts, widely recognized for his deep understanding of fiscal policy, economic governance, and public finance. With decades of experience in taxation, audit, and advisory, he has played a pivotal role in shaping Pakistan’s financial landscape.

Syed Mohammad Shabbar Zaidi is one of Pakistan’s most distinguished chartered accountants and taxation experts, widely recognized for his deep understanding of fiscal policy, economic governance, and public finance. With decades of experience in taxation, audit, and advisory, he has played a pivotal role in shaping Pakistan’s financial landscape.

A fellow member of the Institute of Chartered Accountants of Pakistan, he also served as its President (2005–2006) and as Chairman of the South Asian Federation of Accountants. Mr Zaidi worked with A.F. Ferguson & Co., a member firm of PricewaterhouseCoopers International, from 1979 until his early retirement in 2019 as a Senior Partner, after which he assumed the role of Chairman of the Federal Board of Revenue (FBR). His tenure was marked by bold reforms and policy innovations aimed at strengthening the tax system and promoting fiscal transparency.

Beyond his professional accomplishments, Mr. Zaidi is deeply respected across Pakistan’s business and policy circles. His long-standing relationships with leading families, institutions, and government departments have made him a trusted advisor capable of facilitating strategic collaboration and progress at the highest levels.

Among his non-profit engagements, he serves as a trustee of the Sindh Institute of Urology & Transplantation (SIUT) and sits on the Boards of Governors of Liaquat National Hospital and Karachi School of Business and Leadership.

At ARK Advisory, he brings his unparalleled experience, insight, and influence to guide clients in navigating complex financial and regulatory challenges. His presence reinforces ARK Advisory’s commitment to excellence, integrity, and value-driven advisory services.

Shahab Waheed is a seasoned professional with broad experience in various aspects of investment, accounting, and financial management. As a Fellow Chartered Accountant, Certified Public Accountant, and Chartered Financial Analyst with over 35 years of experience, he has had diverse exposure to real estate, investments, financial advisory, and fund management. He is skilled in investment decision-making and proficient in carrying out valuation assignments and debt restructuring.

Shahab Waheed is a seasoned professional with broad experience in various aspects of investment, accounting, and financial management. As a Fellow Chartered Accountant, Certified Public Accountant, and Chartered Financial Analyst with over 35 years of experience, he has had diverse exposure to real estate, investments, financial advisory, and fund management. He is skilled in investment decision-making and proficient in carrying out valuation assignments and debt restructuring.

He has developed an in-depth understanding of group strategy, accounting, and financial matters. Over the past decade, he has been advising companies on:

During his time with a medium-sized Saudi private group (2013–2023), Shahab served as a Member of the Investment Committee, a Board Member, and an Advisor. He was deeply involved in monitoring the investment performance of the portfolio both local and international including direct investments (listed and unlisted) and operating associates and subsidiaries.

From 2017 onwards, he worked on a major privatization project undertaken by the Kingdom of Saudi Arabia for its flour mill facilities. The Saudi private group, together with its partners, successfully won the bid for one of the two flour mill companies privatized in 2020. In June 2023, the flour mill was successfully listed on Tadawul (Saudi stock exchange).

Additionally, he led an assignment on behalf of the shareholders to explore the creation of a trust structure based outside KSA, aimed at housing the international investments of the Saudi private group within the trust for the benefit of shareholders.

Financial Leadership and Strategic Insight

Financial Leadership and Strategic Insight

Raheel Samad is a seasoned finance professional with extensive experience in financial planning, investment analysis, and strategic advisory across diverse business sectors. At ARK Advisory Ltd., he leads the development of robust financial models and investment frameworks that drive data-informed decision-making and long-term value creation for clients.

Analytical Expertise and Strategic Foresight

Holding advanced academic and professional qualifications in finance and accounting, Raheel combines analytical precision with strategic foresight to support business transformation, optimize capital allocation, and strengthen financial governance.

Commitment to Excellence and Sustainable Growth

His expertise enables clients to navigate complex financial landscapes with clarity and confidence, reinforcing ARK Advisory’s commitment to excellence and sustainable growth.

Farrukh Munir is an accomplished engineer and management professional with over 35 years of senior leadership experience. Holding a Master’s degree in Management from Imperial College London, he brings a unique blend of technical insight and strategic business acumen to the real estate sector.

With 15 years of specialized experience in property acquisition, Mr Munir has a proven track record of identifying, evaluating, and securing high-value residential and commercial investment opportunities. His expertise spans market research, negotiation, valuation, and due diligence ensuring optimal returns and sustainable portfolio growth.

Mr Munir’s analytical approach, combined with his strong stakeholder management skills, enables him to navigate complex transactions with precision and integrity. His deep understanding of market dynamics and property law underpins his ability to deliver exceptional results for investors and partners alike.

Fasahat Khan is a qualified Chartered Certified Accountant and an experienced advisor specializing in Taxation and Corporate Services, providing clients with comprehensive strategic and compliance support. His extensive expertise spans corporate structuring, tax planning, and regulatory compliance, enabling businesses to operate efficiently within the evolving financial and legislative landscape.

Global Experience and Strategic Advisory

With a proven track record in delivering precise and results-oriented solutions across the globe including the U.K., USA, Sweden, France, Germany, Brazil, and Poland Mr Khan is adept at managing complex taxation matters and guiding clients through critical corporate processes. His methodical approach and in-depth understanding of financial governance ensure that each engagement is handled with professionalism, accuracy, and discretion.

Commitment to Excellence and Sustainable Growth

Mr Khan is recognized for his commitment to excellence and client service. He focuses on developing robust, compliant, and sustainable financial frameworks that support business growth and long-term stability. His strategic insight and technical proficiency make him a valuable contributor to the firm’s advisory team.

As an SME, making sure your cashflow is stable and you are protected against payment delays, or even missed payments can be crucial.

Even when business is thriving it can take just a few unpaid invoices to cause significant problems. If you are looking for security and the confidence that you will receive payment for the work you have done or products you have sold, then you can protect your finances with Bad Debt Protection. Bad Debt Protection works alongside your invoice finance facility to protect against the impact of customer non-payment and insolvency.

Our Foreign Exchange service offers competitive rates and enables international payments with minimum effort.

Protecting your business against market volatility has never been more important. Ensuring overseas transactions are cost efficient is vital to the profitability of your business. Our Foreign Exchange service offers competitive rates and enables international payments with minimum effort, whether you have an immediate trading need or want to lock in a rate for a future date.

Key benefits of Asset Finance

Fast

Buy what you need today. Do not wait until you have got cash.

Flexible

Option to return, extend or purchase at the end of the period.

Cash efficient

•No upfront costs

•Release cash from existing assets

•Spread payments

Tax deductible

•Reclaim VAT and offset repayment interest against profit

Speak to your accountant or business advisor for advice on how this works.

We finance a broad range of assets, including hard assets such as vehicles, plant and machinery and over a hundred types of soft assets, for example, cleaning equipment, IT and software, AV equipment and scaffolding. We will fund assets up to the value of £5m.

Get your cash flowing today

Managing cashflow is essential to business success. Your customers may pay on credit terms of up to 90 days and may not pay on time. Invoice Finance enables you to release your cash more quickly than waiting for customers to pay, allowing you to manage cashflow, and your business, more effectively.